ILIT stands for Irrevocable Life Insurance Trust.

ILITs are essentially trusts made to own and control a term or whole life insurance policy. The ILIT manages and distributes the proceeds paid out by a life insurance policy when the insured person passes away. Because ILITs are not controlled by the person who funds them, they are not considered part of the estate. Therefore, ILITs can help you avoid estate taxes.

The main reason ILITs are used is to avoid or reduce your estate taxes when you die. However, ILITs are also very useful in two other situations:

- To avoid the loss of government benefits like social security disability when your beneficiaries receive their life insurance payout

- To avoid your minor children being named as direct beneficiaries, which can cause many headaches when you pass away

Let’s go through some common questions on ILITs to help you decide whether they are right for you.

Are life insurance payouts taxable?

As with anything in life, if you fail to plan, then you plan to fail. That is especially true with life insurance policies.

According to the IRS, in general, you don’t need to report life insurance payouts that you receive. If I were to die tomorrow, my wife wouldn’t need to report my life insurance proceeds on her taxes for next year because:

- The beneficiary of my life insurance is my wife and not my estate

- The pay-out will have been made to my wife immediately upon my death, therefore there would be no interest earned on that payout (otherwise that interest would have been taxable)

If the above were not true, she could very well pay taxes on any life insurance payout.

Planning tip: Whether or not you decide ILITs are for you, never name your estate as the beneficiary of your life insurance policy. By naming your significant other as beneficiary, you will avoid life insurance proceeds from being included in your estate when you pass away.

Under what circumstances would I pay taxes on a life insurance payout?

Your beneficiary will pay taxes on a life insurance payout if:

- Any interest was earned on the life insurance payout before it is paid out to the beneficiary

- The life insurance policy was a whole life insurance policy set up less than three years before the deceased passed away. This is called the “three-year rule”

- The payout is made to an estate instead of to a beneficiary and the estate is worth more than a certain amount

In 2021, that certain amount for the estate to be taxed at the federal level is $11.70 million dollars. So, if your life insurance payout is part of the estate and not paid directly to your beneficiary, and the value of your estate is over $11.70 million dollars, your estate will pay taxes to the federal government on that life insurance payout.

How much will the IRS want in taxes?

That can vary between 18% to 40% depending on the amount over $11.70 million that your estate is worth.

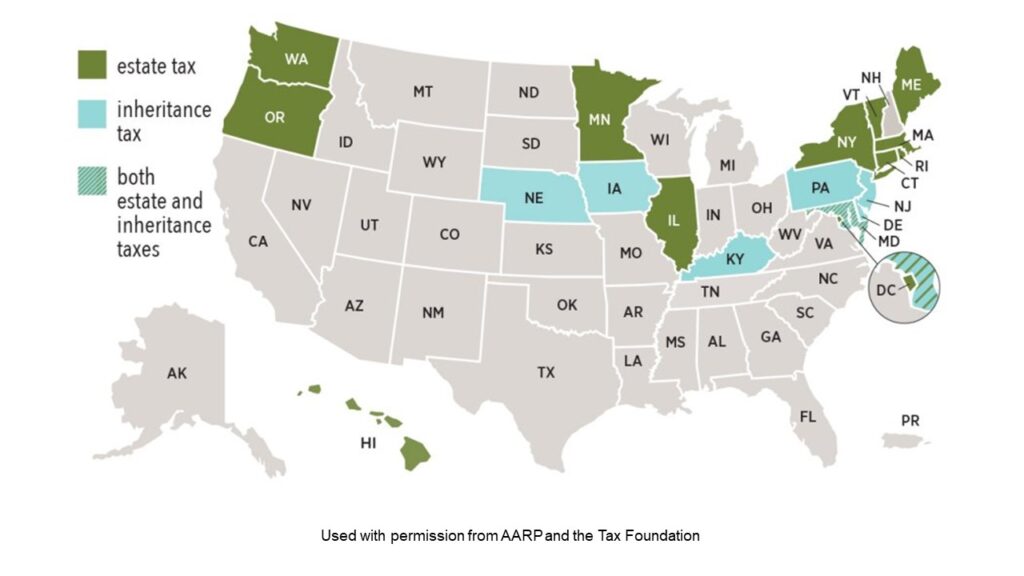

17 states will also want a share of any estates or inheritances if the estate is worth more than a certain amount. For some states, that threshold is as low as $1 million with the percentage being taken out for taxes as high as 20%.

In some states, they have something called an “inheritance tax”. The beneficiary pays inheritance taxes, whereas the estate pays estate taxes. It’s really 6 one way, ½ a dozen the other.

Therefore, if you don’t plan well, you could see a significant portion of your life insurance payout taken away by taxes.

Should I be worried about hitting the $11.7 million dollar threshold?

While $11.70 million dollars is a lot of money, the threshold isn’t always so high. Certainly, this threshold is subject to change in the future. For example, the threshold in 2017 was $5.49 million, meaning that any estate higher than this figure would have been taxed then.

If you own a farm or small business, you should also be concerned.

The average cost per acre for land for cattle to pasture in my state of Mississippi is $2,450 per acre. If you have a 2,000-acre pasture, that could be worth $4,950,000 in just the land alone! Then, if you factor in the cattle, machinery, house, savings, etc. you may be closer to that limit than you think.

The same is true for small business owners. If your small business is included in your estate, your beneficiaries may be paying a large sum of money in taxes if your estate is not properly managed. What’s worse is the fact that they may need to sell part of the business to cover taxes due if your life insurance doesn’t fully cover the bill.

Could we lose out on Medicaid or Social Security Disability if a beneficiary receives a life insurance payout?

You very well could.

In my home state of Mississippi, if you have assets over $4,000 or if you’re married and have assets over $8,000, then you no longer qualify for Medicaid.

Keep in mind, there’s a difference between the two Social Security disability programs. You have SSDI (Social Security Disability Insurance) and SSI (Supplemental Security Income). With SSDI, there’s no limit to the number of assets you can have but you must have worked and paid FICA taxes for a certain number of years. On the other hand, SSI is needs-based and the asset limit is $2,000 for an individual and $3,000 for a couple.

So, if you received a life insurance payout of just $10,000 in Mississippi, you are no longer eligible for Medicaid or SSI. However, if you structure the life insurance payout through an ILIT, you can resolve this issue.

What if my children are minors?

Children who are minors cannot legally receive life insurance proceeds. If you are a single parent, or both you and your spouse sadly pass away, and your life insurance has your children as named beneficiaries, they will run into significant legal complications before they can access the life insurance payout.

The state will need to appoint a legal guardian which can be a costly and lengthy process. In the meantime, your children will have to rely on support from family members rather than the life insurance proceeds. Then, the legal guardian will have the discretion to direct the money the way they prefer, and not necessarily how you would have done it.

You can avoid costs and complications from naming your children as life insurance beneficiaries by setting up ILITs. The ILIT trustee will follow your instructions, and will protect your wishes after death.

So how do ILITs help?

An ILIT sets up a trust that manages life insurance policies and their subsequent payouts.

Remember, in a trust you have 3 parties:

The Grantor – The person who funds the trust and who is covered by the life insurance

The Trustee – The person who manages the trust

The Beneficiary – The person(s) who receives the benefit

Because the grantor who funds the ILIT doesn’t have a hand in its operation, the tax authorities don’t consider it part of the person’s estate and the funds thus avoid estate taxes. ILITs can also handle distribution of the life insurance funds and thus avoid issues with Medicaid or SSI eligibility to any beneficiaries who may be sensitive to those issues. Similarly, you can avoid issues with minors as beneficiaries by buying life insurance through an ILIT.

It’s important to remind you about the “three-year rule”. If the ILIT is set up within 3 years of the insured person’s death, then it would be considered part of the insured person’s estate and thus subject to estate taxes. Plan early to avoid this scenario!

Can any type of life insurance go into ILITs?

Both term and whole life insurance can go into ILITs.

Another type of life insurance used in ILITs is “second-to-die” life insurance. This is where a payout is made after two people die, typically a husband and wife. For example, if my wife and I had “second-to-die” life insurance, we would both have to die before our beneficiary received a payout.

How is the life insurance in ILITs paid for?

The grantor contributes money to the ILIT and the trustee pays for the life insurance with this money. For example, the grantor (this is likely you) will put in a certain amount of money in the ILIT upfront or periodically, and the trustee will use that money to pay the life insurance premiums.

What are the fees associated with getting an ILIT?

The cost to set up ILITs and the fees associated with them depend on who is offering the product and ongoing service.

As an example, LPL Financial has the following fees

| LPL Financial | |

| Set-Up Fee | $200 |

| Annual Fee | $1,200 |

| Distribution Fee (during first 12 months after death of insured) | 1% |

There are also wide variations in rules and yearly fees when it comes to ILITs. For example, South Dakota Trust Company has no account minimum to start a trust but has yearly fees between $4,000-$5,000 on some forms of trusts.

Where do I set up an ILIT?

You can set up ILITs wherever you can set up a trust fund which is usually any firm with “wealth management” or “trust” in its name. You should consider using a firm that you personally trust and bank with before searching out other firms that you’re unfamiliar with. This will allow you to keep your financial house in order.

For a recommendation on a few places that can help you set up ILITs, you can visit:

Last tip to get your finances in order

For more financial guidance from certified professionals at no cost to you, refer Pasito to your company Through personalized benefits and financial guidance, Pasito helps you cut down on thousands of taxes annually. These tax savings can then be distributed elsewhere, thus increasing your financial wellness.

Disclaimer: We try our best to provide you helpful content. However, we do not offer financial, legal, or tax advice. Please speak with a professional about your personal situation.