Congratulations! You are a financial planning superstar. “How do you know that?” you wonder. “He doesn’t even know me!”. I know that whether you searched Roth IRA for Kids all on your own or just happened upon this article, you are the type of person that is curious about ways to efficiently plan towards your goals.

And boy do I have good news…a Roth IRA for kids is absolutely a real thing. I will help you learn more about them so that you can decide if it is the right move for you and your kids.

What is a Roth IRA for kids?

A Roth IRA for kids is no different than the Roth IRA that you might already have for yourself. If you aren’t sure what a Roth IRA is, don’t worry. I’ll cover the highlights here.

A Roth IRA is simply a type of retirement savings account that helps you save and invest money for retirement. The main benefit of a Roth IRA is that your money grows tax-free and, if used correctly, your withdrawals are tax and penalty-free. Roth IRAs have certain rules and restrictions, including:

Contributions

- You can only make contributions on an after-tax basis. This means you deposit money into a Roth IRA after paying taxes on this money

- Contributions to your Roth IRA can only come from earned income, that is, income from paid work, not from gifts or allowances. This is typically the limiting factor in setting up a Roth IRA for kids.

- Contributions are limited based on income, with most people eligible to contribute up to $6,000 for 2021

Withdrawals

- Contributions can be withdrawn at any time without incurring a penalty

- If you are older than 59½ and the account is at least 5 years old, earnings (investment growth) can be withdrawn without paying a penalty. This is in addition to the tax-free withdrawal of contributions

- If you are younger than 59½ and opened the Roth IRA less than 5 years ago, you will pay taxes and penalties on earnings

- Funds can be withdrawn penalty-free for special exceptions like buying your first home, paying for the birth of a child, or funding college expenses

If you would like to learn more about Roth IRAs in an easy-to-navigate format, head over to Roth IRAs: The Complete Guide. If you like details and want to review this information directly from the source, venture over to IRS Publication 590-A, the gospel from which everyone else preaches.

Should I open a Roth IRA for my child?

The easy answer is absolutely, unequivocally YES! The reason…time-value of money.

Consider three hypothetical scenarios

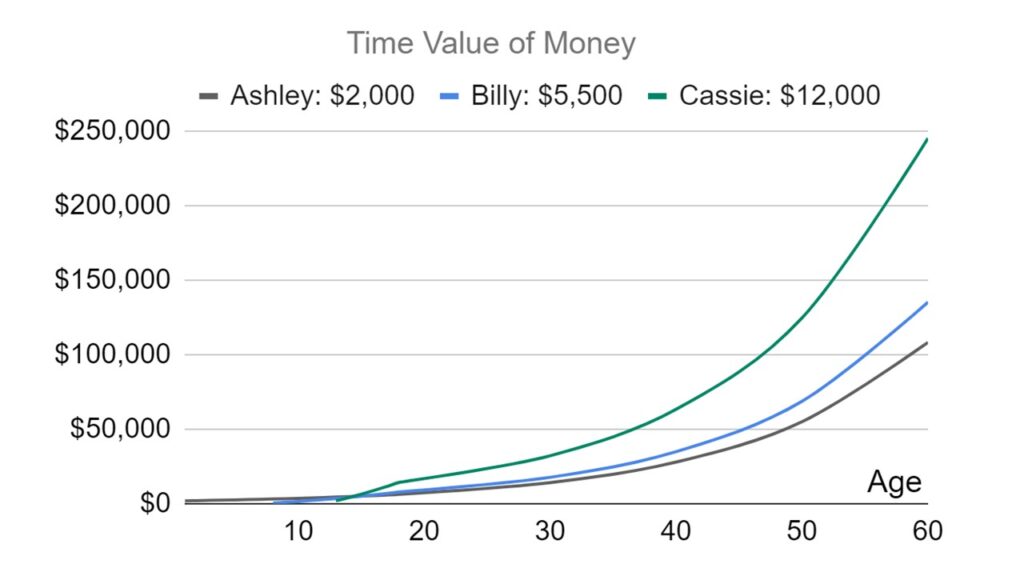

The time-value of money graph below shows three hypothetical scenarios where a child invests all his or her earnings in a Roth IRA for kids.

- Ashley – Her parents signed her up as a baby model shooting baby commercials paying $2,000 at age 1

- Billy – He is a creative kid that started making YouTube videos at age 8, making $500 per year until age 18

- Cassie – She started cutting grass at age 13, making $2,000 per season until age 18

Because Ashley, Billy, and Cassie’s parents knew about the advantages of a Roth IRA for kids and helped them invest their earnings, each child would have over $100,000 saved by age 59½ without a single additional contribution as an adult. Ashley, Billy, and Cassie would have access to these funds sooner to pay for college, the down payment for a home, and more, without incurring any tax penalty.

What might your scenario be?

There are a limitless number of ways for how your child might have earned income. For example, consider how you can assign meaningful work to your child at an early age if you are self-employed.

If you would like to learn more about the time value of money and play with your scenarios then check out this neat calculator. A 7% annual return was assumed in the scenarios graphed above.

Can parents contribute to a Roth IRA for a child?

Teaching your child about the value of saving and investing should start at a very early age. As with most things, teaching by example is best. Still, even the most frugal adults do not save 100% of their earnings, and it is unreasonable to expect a child to part with all of the fruits of her labor.

Consider matching their investments

The rules say contributions cannot exceed one’s earnings, but the contributions do not have to be the same dollars your child earned. You can make contributions with your own money and allow your child to spend hers.

Even better, you can create an incentive, much like a 401k match, agreeing to match dollar-for-dollar any contributions your child makes. Be creative, and have fun with it. There is no right or wrong way to save. Just encourage saving something! Teaming up with your child on a Roth IRA for kids can be a great way to have financial conversations with your children and continually reinforce the importance of saving a portion of their earnings.

Be sure to stay below the total earnings or annual limit. For example, if your daughter makes $2,000, then $2,000 is the most that can be contributed in that year. However, if she makes $7,000, the total contribution, parent plus child, is limited to $6,000, the annual IRS limit.

Are you ready to learn how to start a Roth IRA for Kids?

How to start a Roth IRA for a child

Opening a Roth IRA for a child could not be easier. Because your child is a minor, you will need to set up a custodial account. This is very similar to opening a custodial checking or savings account at a traditional bank. The parent or guardian, or even grandparent, manages the account until the child turns 18 (or older in some states). Then the child retains control from thereon.

Not every financial institution that manages Roth IRAs offers custodial accounts, but here are some that do:

- M1 Finance – Custodial Accounts (requires M1 Plus membership)

- E*Trade – IRA for Minors

- Schwab – Custodial IRA

- Fidelity – Turbocharge your child’s retirement

In summary

- Can you set up a Roth IRA for kids? YES!

- Setting up a Roth IRA for kids can be an excellent way to teach your child healthy, lifelong financial skills.

- Your child won’t have to wait until retirement to use the funds. They can withdraw funds from a Roth IRA for kids penalty-free for a first house, pay the cost of having a baby, or for college expenses.

- Start with your child’s first earned income to provide an early start, letting the magic of compound interest turn a very small sum of money into a substantial future nest egg.

For even more financial guidance from certified professionals at no cost to you, refer Pasito to your company Through personalized benefits and financial guidance, Pasito helps you cut down on thousands of taxes annually. These tax savings can then be distributed elsewhere (think: Roth IRA for your kids), thus increasing your financial wellness.

Disclaimer: We try our best to provide you helpful content. However, we do not offer financial, legal, or tax advice. Please speak with a professional about your personal situation.